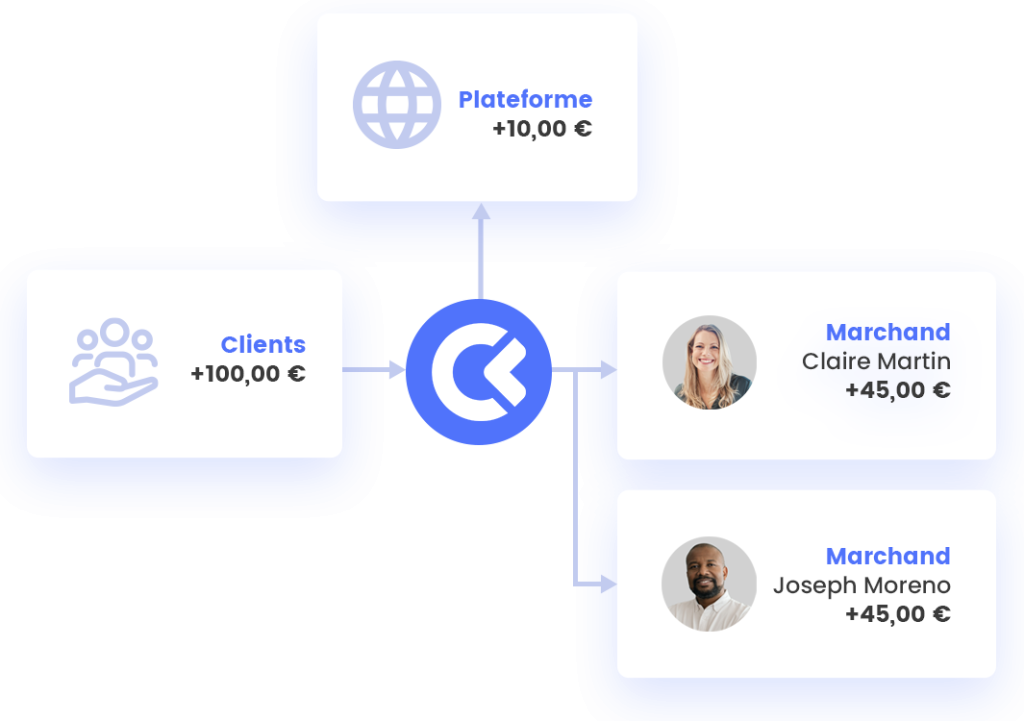

Collect and transfer third party payments

With CentralPay, platforms collect customer payments, transfer them automatically to their merchants, then receive their commission.

Collection

Accept more payments, easily

Benefit from all CentralPay collection services:

Transfer

Transfer payments to your merchants' accounts

Communicate shopping cart information to CentralPay, which will transfer your merchants’ revenues and your commission:

Merchants

A simple and secure merchant relationship

Turnkey onboarding

Your merchants open an account by following the CentralPay onboarding path, which can be integrated via API or accessed from a hosted portal.

Merchant backoffice access

Your merchants have access to the CentralPay backoffice to view their transactions, make exports and manage their accounts.

Payout management

Your merchants benefit from an automatic (daily, weekly or monthly) or manual payout function from their CentralPay backoffice.

Frequently asked questions

Learn all about the CentralPay third party payment

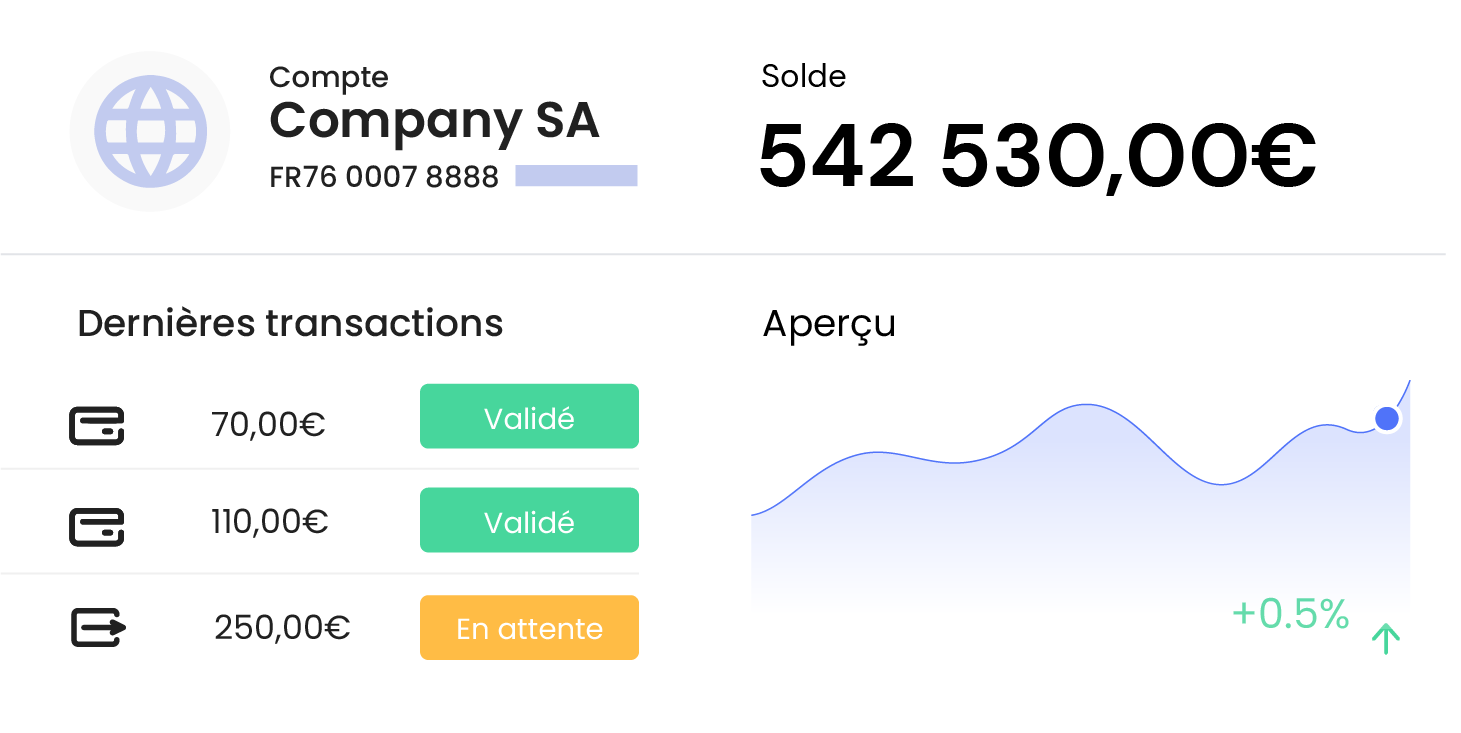

The payment account gives you access to all CentralPay collection services:

- Collect funds in currency,

- from any channel (online, sms/email...)

- and from any payment method ( credit cards, bank transfers, direct debits, etc.).

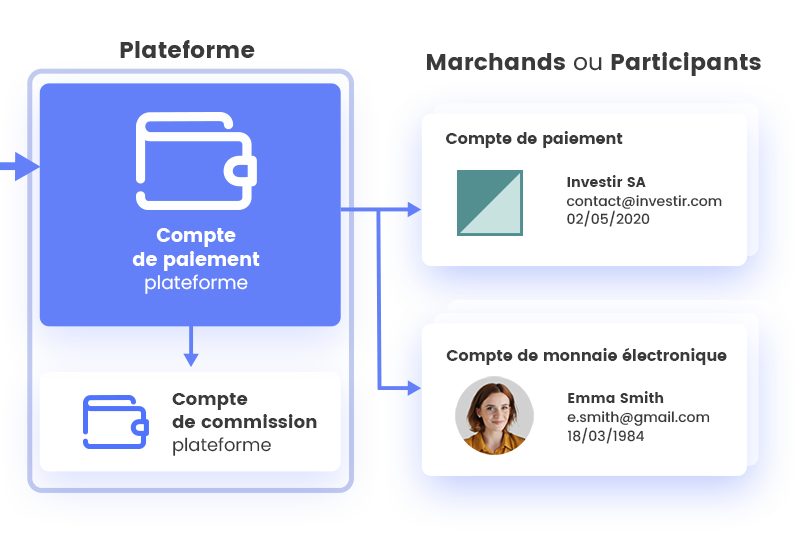

Yes. Depending on the needs of your business, CentralPay may create several payment accounts with different functions:

- "Platform" payment accounts: Opened by CentralPay, the platform payment account collects customer payments. It is only used to transfer payments and is not linked to a bank account.

- "Platform commissions" payment account: Opened in the name of the platform, this account enables it to receive its commissions and CentralPay to deduct its service fees.

- "Merchant" payment accounts: These are opened in the names of the platform's merchants, enabling them to receive income linked to sales made on the platform.

CentralPay simplifies the payment accounts opening by dematerializing the contracting and onboarding process:

- Collection of ID and supporting documents by CentralPay (API or hosted portal)

- Electronic signature of the platform and CentralPay T&C during onboarding

- Documents check and account opening by CentralPay teams

Two types of flows are involved in the use of a CentralPay escrow account:

- In pay-in, the payment account accepts payment from all sales channels (online, in-store, email and SMS) and payment methods (credit card, bank transfer, SDD direct debit and payment initiation).

- In pay-out, the payment account enables you to programme the transfer of funds to the associated bank account.

Under the Directive on Payment Services 2 (PSD2), which regulates platforms operating on behalf of third parties, three options are possible:

- Be a registered Payment Institution with the ACPR: This accreditation allows you to manage your collections and transfers in total autonomy. However, it requires sufficient financial, human and technical resources to be and remain in line with the regulator’s requirements.

- Applying for an authorization exemption: There are exceptional grounds for obtaining an exemption from the ACPR, for example in the case of “limited range of products and services” or “limited network of acceptors”.

- Use a Payment Service Provider (PSP): Platforms can manage their transactions using the payment services of an Authorized Institution such as CentralPay. These Payment Service Provider Agents are supported by their Payment Institution on various subjects: compliance with the regulations governing Payment Services (regulation, reporting, AML/CTF, etc.), removal of technical barriers and validation of financial plans to collect and transfer their transactions.

Yes, payment wallets can be closed. In accordance with the GDPR regulations, CentralPay is obliged to keep the data relating to these accounts for a certain period of time, before destroying them.