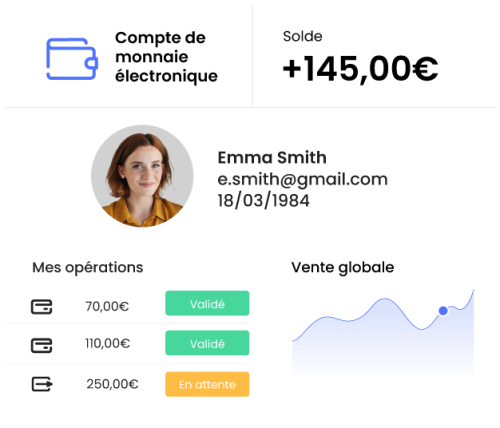

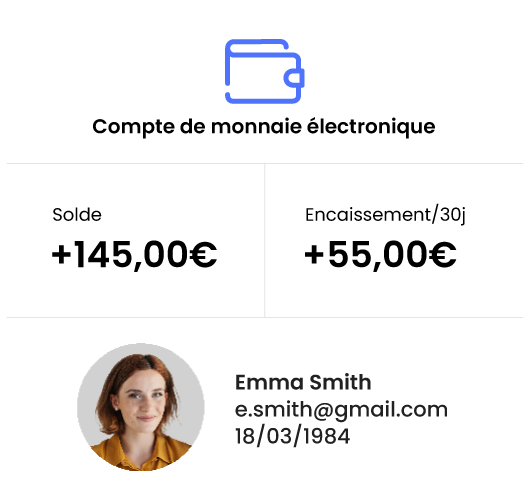

Electronic money accounts to make it easier to receive and exchange funds

Easy Wallet's e-money account enables platform merchants to receive or transfer limited amounts of money, without the need for identification.

Use case

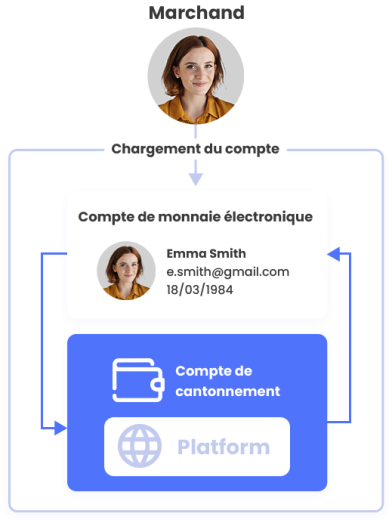

An e-money account adapted to C2C

Process transactions for your merchants and credit electronic money accounts opened in their name:

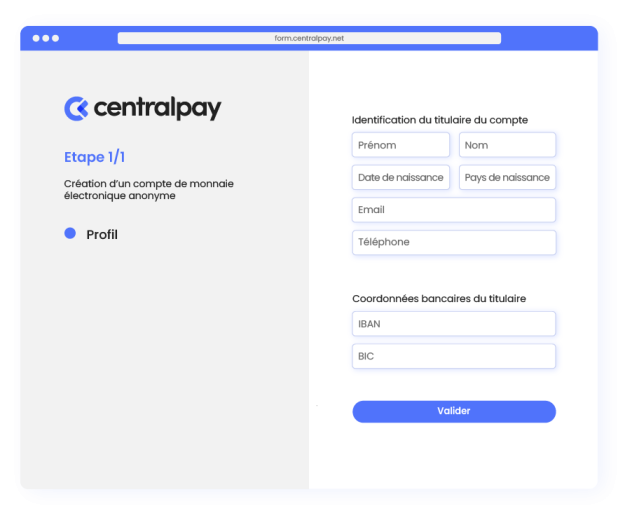

Onboarding

Instant account creation

Create an anonymous e-money account instantly and without any document collection:

Functionality

Optimized financial risk management

Control your financial risk in the event of customer disputes or fraud:

Frequently asked questions

Learn all about the CentralPay e-money account

Electronic money is defined above all as prepayment followed by storage of “traditional” money on another medium. In the true sense of the word, therefore, money is not created, but a dematerialized instrument of traditional money is issued to facilitate transactions in a digital economy.

Electronic money is not, in itself, a new type of currency, creating a third category after fiat and scriptural money. It's a new cashless payment instrument used to carry out a payment transaction.

Electronic money can be used in two main contexts:

- To enable its customers to load funds via a conventional payment method, and then to use them freely at a later date in its acceptors' network.

Example: purchase a gift card, load a digital wallet that can be used in a marketplace or a network of retailers, etc.

- Facilitate the payment of small amounts to customers for the sale of a product or service or for the receipt of compensation.

Example: sale of a product or service on a C2C platform, payment of a refund or credit note, etc.

La monnaie électronique est définie comme « une valeur monétaire qui est stockée sous une forme électronique, y compris magnétique, représentant une créance sur l'émetteur, qui est émise contre la remise de fonds aux fins d'opérations de paiement définies à l'article L. 133-3 [du CMF] et qui est acceptée par une personne physique ou morale autre que l'émetteur de monnaie électronique » (Article L. 315-1, I CMF).

Since the "Electronic Money Directive 1" of March 2000, electronic money has been a payment instrument resulting from the practice of dematerialized exchanges.

Initially little used, its use and scope were reinforced by the Electronic Money Directive 2 of September 16, 2009, then transposed into French law in January 2013.

As e-money is governed by the French Monetary and Financial Code, it can only be issued under the supervision of credit or e-money institutions approved by the ACPR ("Autorité de contrôle prudentiel et de résolution de la Banque de France").