Optimize and regulate your financial platform payments

With CentralPay, financial or crowdfunding platforms can automate contributions collection, beneficiaries identification and participants compensation.

With CentralPay, financial or crowdfunding platforms can automate contributions collection, beneficiaries identification and participants compensation.

Find out how CentralPay meets your challenges

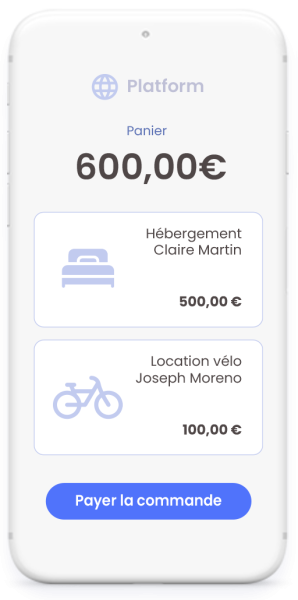

CentralPay payment methods automate the collection and management of payments by credit card, direct debit and bank transfer.

For bank transfer payments, you receive your participants’ funds on virtual IBANs differentiated by project and investor, so that all your customer identification and bank reconciliation tasks are carried out instantly and automatically.

For projects with financial compensation, creating an account for each of your investors enables you to identify and pay them automatically.

Simplified KYC process, automatic ID validation, automatic certificate of incorporation retrieval: investing on your platform has never been so easy.

Regulators are particularly attentive to the activities of financial and crowdfunding platforms. There are a number of different ways of operating, which requires their payment institution partner to be highly agile and well-versed in legal matters. With CentralPay, you benefit from:

All about CentralPay crowdfunding payment solution

The solution is suitable for all European partners providing crowdfunding services, regardless of their business model:

CentralPay accepts partners with AMF authorization, such as ESCP (European Crowdfunding Service Provider) and ISP (Investment service provider), or with a legal note justifying their legal model.

The solution is modular and can be adapted to each platform, with 3 operating options: