Collect debts easily

With CentralPay, debt collection departments and agencies can simplify and automate their debtors' payment processes.

Issues

What difficulties are debt collection professionals facing?

The lack of optimisation of the debtor's payment path complicates the work of debt collection professionals and lengthens payment times:

Unsynchronised channels complicate the debt collection process (reminders by phone, email, SMS, post, etc.) and make it difficult to get a clear picture.

Poorly digitised payment methods (SEPA bank transfers or direct debits), which generate accounting processing on receipt of funds, often managed manually.

Complex credit management involving manual actions to limit the impact on cash flow and the associated costs (chasing up debtors, collecting debts, reconciling payments, etc.).

Solution

Unified and omnichannel debt collection processes

Recover your debts easily, from any channel.

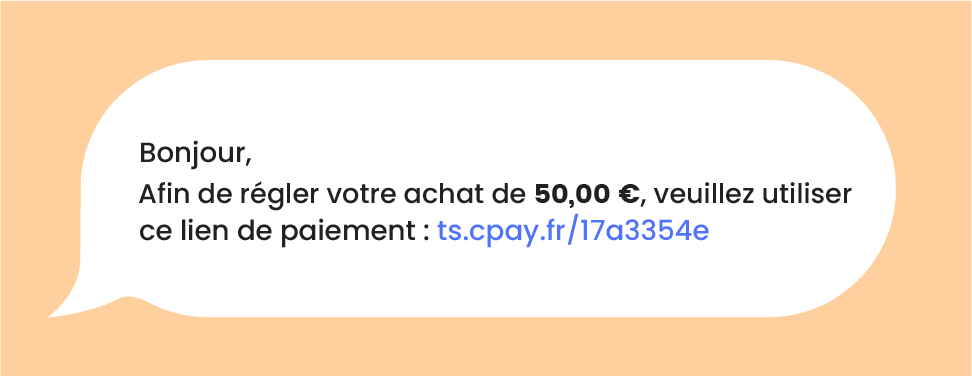

The dispatch system integrates URL or QR Code payment links into the communications, giving customers the choice of payment method.

The debtor accesses the payment link in their protected area and pays their debt online.

During a call, the operator sends the payment link for the debt directly to the debtor by email or text message.

Digitized payment methods

Adapt payment methods to your business, collection path and customers.

Instant SEPA bank transfers

CentralPay generates and presents a different virtual IBAN to each of your customers. This means that when CentralPay receives a bank transfer, it identifies the sender and automatically reconciles the invoice for you, even if the reference number is incorrect.

Payment initiation (Pay by Bank)

Send instant transfer requests to your customers, directly into their banking application. You fill in the amount, your IBAN, and your references for them, so they only have to validate the bank transfer.

SEPA Direct Debit

Collect contact details and create mandates in just a few seconds using our online form. Then CentralPay debits your customers according to your subscription models, in installments or individually as your invoices progress.

Credit card

Accept payments by CB, Visa, Mastercard and American Express or via ApplePay and GooglePay. Take advantage of the various CentralPay payment methods: simple transaction, subscription, installments, secure card imprint, pre-authorization.

Our ambition

Fully automated debt collection

We can help you optimise your debt collection.

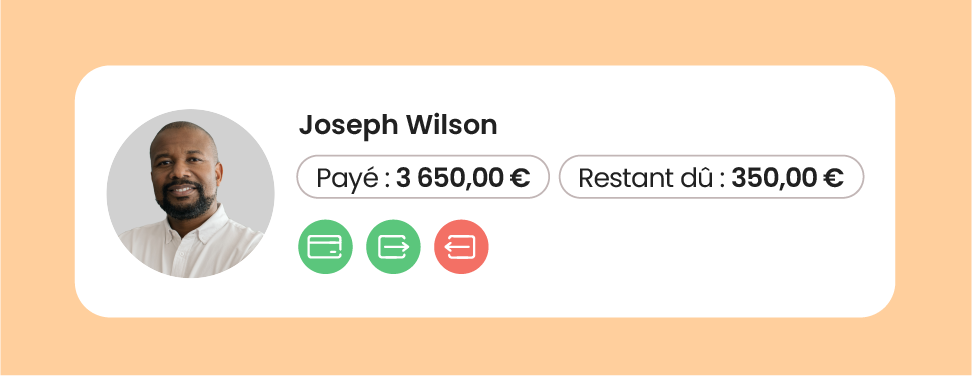

Unified debt collection

Unify your credit management by easily controlling all your single payments (cards, transfers and direct debits) or by automating the setting up of installment plans (cards and direct debits).

Customised paths

Automate your debt collection requests using email and SMS reminder scenarios. You define the content and frequency so that you retain control of your customer relations.

Automated notifications

Track the status of your debt payments in real time in your information system, thanks to automatic updates via API or CSV files. This means you can automatically inform or follow-up with your debtors.

Integration

Full connectivity via API or raw data

Automate data exchanges between CentralPay and your various tools and partners. For example, your debts can be imported to automatically issue payment requests to your customers, while CentralPay transmits the payment status in return.

CentralPay manages exchanges by depositing files (CSV, bank formats, etc.) or sends Hook notifications in real time via API, depending on your requirements.

Go further in automating your processes by connecting to CentralPay :

ERP

Information System (IS)

Invoice dematerialisation platform

Debt collection solution

Financing solutions (Buy Now Pay Later, credit, etc.)

La solution de recouvrement de créances CentralPay nous a permis de sécuriser et d’optimiser nos parcours d’encaissement par carte, virement et prélèvement puis d’automatiser toute la chaîne : de notre espace débiteur au rapprochement des opérations dans notre SI.

Directrice Générale

France Contentieux – Groupe Konecta

Frequently asked questions

All about the CentralPay debt collection solution

The solution is available to companies registered in the European Economic Area wishing to optimise their debt collection procedures out of court.

The solution is designed to automate day-to-day management:

- In-house debt collectors

- Debt collection agencies or bailiffs

CentralPay is also used by collection software companies looking to expand their services.

The solution enables the payment of debts owed by debtors located in France and abroad.

It simplifies and automates out-of-court debt collection tasks (payment of unpaid invoices) as far as possible, to limit the need to resort to litigation or the courts.

No, CentralPay does not offer debt financing (nor cash advances, nor factoring...).

The CentralPay solution enables debt collection professionals to reduce the need to buy back debts, thanks to automation and reminder services that cut payment times and therefore reduce non-payment.

If you want to buy back your debts, we recommend that you turn to factors or factoring companies.

CentralPay manages data exchange with your ERP and Information Systems, via API or by recurring delivery of CSV files via an SFTP server.

Operation:

The solution simplifies and automates the payment of debt collection:

- Your software sends CentralPay the list of debts due on a daily basis

- CentralPay creates a dedicated payment page for each one and returns them to you.

- You can integrate these payment URLs into your debtor area, your email/SMS communications, and as QR codes on your paper mail.

- CentralPay notifies your ERP in real time as soon as a payment is received, whether by credit card, bank transfer or SEPA direct debit.