Collect payment, quickly

Businesses improve their cash flow by automating all customer payment processes with CentralPay.

Issues

What difficulties are companies facing?

B2C e-merchants now benefit from fully automated payments. In contrast, conventional companies find it more difficult to streamline their collection processes. Three main factors are involved:

A variety of payment conditions

which make customer transactions more complex (payment on order, on account, in arrears by invoice, etc.).

Poorly digitised payment methods (SEPA bank transfer or direct debit), generating accounting processing on receipt of funds, which is often managed manually.

The complex credit management means that action must be taken to limit the impact on cash flow: identifying late payments, notifying teams and debt recovery.

Solution

Paths adapted to each payment condition

Get paid simply, regardless of the payment terms negotiated.

Integrate a payment page into your email/sms communications or directly into your website.

Get your deposit paid instantly on your website or by email/sms payment link, then collect your balance with a second payment link attached to your invoice. Otherwise, schedule both payments automatically by SEPA direct debit.

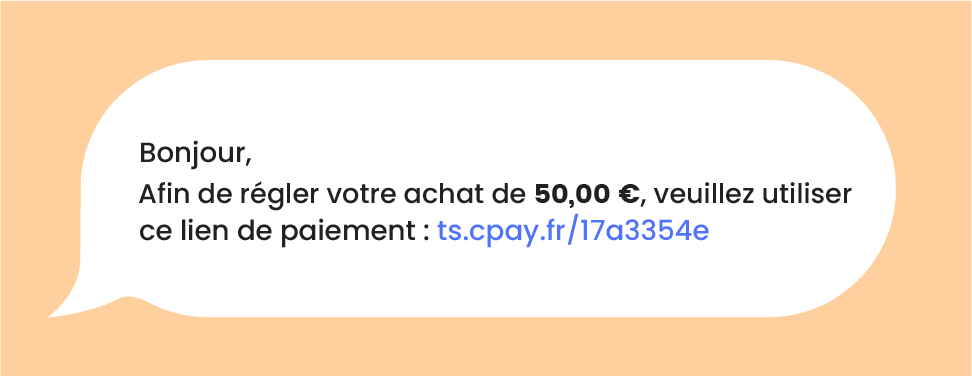

Receive your invoice collection using an email/sms payment link attached to your invoice. Customer reminders are automated according to the due date of your invoice.

Digitized payment methods

Adapt payment methods to your business, sales channels and customers.

Instant SEPA bank transfers

CentralPay generates and presents a different virtual IBAN to each of your customers. This means that when CentralPay receives a bank transfer, it identifies the sender and automatically reconciles the invoice for you, even if the reference number is incorrect.

Payment initiation (Pay by Bank)

Send instant transfer requests to your customers, directly into their banking application. You fill in the amount, your IBAN, and your references for them, so they only have to validate the bank transfer.

SEPA Direct Debit

Collect contact details and create mandates in just a few seconds using our online form. Then CentralPay debits your customers according to your subscription models, in installments or individually as your invoices progress.

Credit card

Accept payments by CB, Visa, Mastercard and American Express or via ApplePay and GooglePay. Take advantage of the various CentralPay payment methods: simple transaction, subscription, installments, secure card imprint, pre-authorization.

Our ambition

Automated credit management

We help you optimise your customer payment processing.

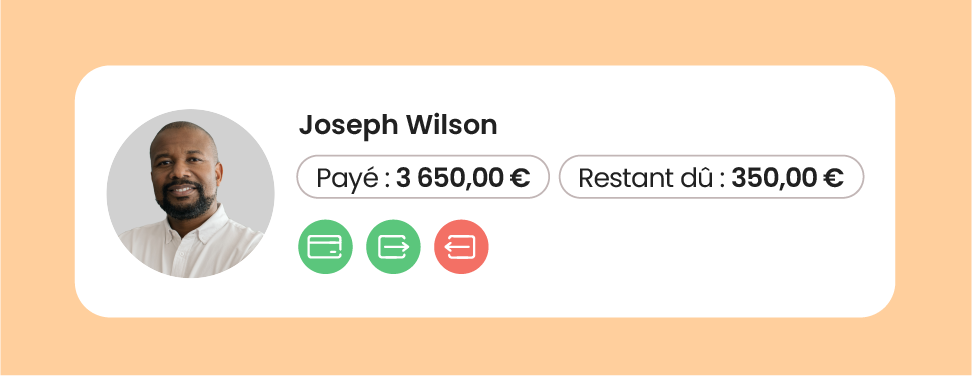

Unified customer profiles

Unify and secure all your customer data to make it easier to manage: payment history (all sales channels and payment methods combined), payment instruments, scheduled or pending payments.

Automated reminders

Automate your customer communications linked to the invoice and debt collection processes using email and SMS reminder scenarios. You define the content and frequency so that you retain control of your customer relations.

Automated notifications

Create customer notifications or internal email or sms alerts based on various events that may occur on your account: failure of a customer payment, receipt of a bank transfer, direct debit due date, expiry of a credit card, etc.

Integration

Full connectivity via API or raw data

Automate data exchanges between CentralPay and your various tools and partners. For example, your debts can be imported to automatically issue payment requests to your customers, while CentralPay transmits the payment status in return.

CentralPay manages exchanges by depositing files (CSV, bank formats, etc.) or sends Hook notifications in real time via API, depending on your requirements.

Go further in automating your processes by connecting to CentralPay :

ERP

Information System (IS)

Debt collect solution

Invoice dematerialisation platform

Financing solutions (Buy Now Pay Later, credit, etc.)

The CentralPay payment solution has enabled us to collect and reconcile our invoices easily, while offering our customers a smooth payment path. The CentralPay teams were very responsive and quick to adapt their platform to our needs.

Matthieu Philippe

Digital project manager – Digital strategy

Frequently asked questions

All about CentralPay corporate payment solution

The solution is available to SMEs, ESIs and large companies registered in the European Economic Area that want to digitise their invoice collection.

The solution is designed to automate the day-to-day management of finance and accounting departments. The aim is to optimise cash flow and related costs.

Yes, the solution meets a number of e-reporting challenges linked to e-invoicing regulations:

- Process payment reconciliations within mandatory deadlines

- Transmit payment statuses to dematerialization platforms

- Provide full traceability of payments, even in the absence of transfer references

No, companies keep their traditional bank account.

Opening a CentralPay payment account offers additional services not provided by banks. It enables you to collect all your customer payments and synchronise them with your financial management tools.

So you can:

- Centralise and view the status of invoice payments (across all payment channels and methods).

- Automate your customer communications linked to payments, according to predefined events (reminders, notifications, scenarios etc.).

- Keep your teams informed in real time about your collection activities and the actions to be taken.

The funds collected are then transferred to your bank account according to the frequency you have set.

CentralPay manages data exchange with the main business tools on the market (ERP, information systems, invoicing software, etc.) as well as with your own in-house tools.

The connection can be developed via API or via recurring delivery of CSV files on a SFTP server.